When you look at the average Property Management portfolio, most landlords get stuck on one or two properties and fail to grow their portfolio to the levels that they could. Why is it that so many landlords fail to achieve their goals when they get into Property Investment?

When you look at the average Property Management portfolio, most landlords get stuck on one or two properties and fail to grow their portfolio to the levels that they could. Why is it that so many landlords fail to achieve their goals when they get into Property Investment?

Your Property Manager Can Help

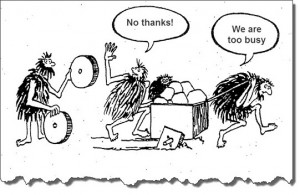

There are two main reasons for this. The first is failing to plan and not having a strategy. However, probably the main reason is that people get too busy to search. This is where your Property Manager can assist you. Your Property Manager will understand the local market and they will be able to inform you regarding realistic rents for potential investments. They can also assist you with identifying what type of property your potential investments will attract. This will give you a good indication of potential income for your property.

Your Property Manager will also be able to give recommendations on how to increase the rent through renovations and décor. This can important as the right advice can see you add capital value to your portfolio and increase the income through higher rents.

The ability to do this means that you can then use the new found equity in your property to leverage and grow your portfolio. However, you have to ensure that you do your homework and know what the income and the outgoings are likely to be.

Take into account repairs and maintenance

You have to allocate a percentage of income towards this. It will vary depending on the age and type of property. For example an older weatherboard property will probably cost more to maintain than a two-bedroom apartment in a city.

To succeed in property investment you need to build a great team around you. Your Property Manager should be vital to your success.

Ready to grow your Auckland portfolio?

We can help! Contact us today.