Rental industry set to be shaken up by new Labour led-Government

A big-shake up to the residential rental industry is imminent under the newly-formed Labour led Government.

Within the first 100 days Prime Minister elect Jacinda Ardern, New Zealand First leader Winston Peters and co have a mountain of initiatives to tick off.

Labour will hit the ground running in Government, with a programme of work across housing, health, education, families, the environment and other priority areas.

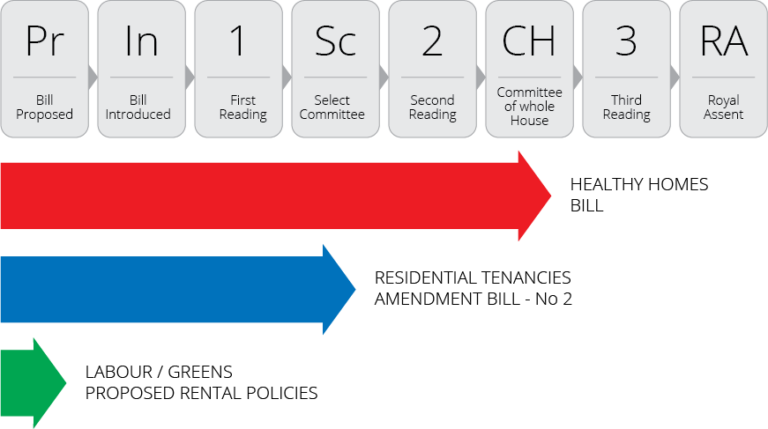

As far as the rental industry is concerned, passing the Healthy Home Guarantees Bill, which will ensure that all rental properties will meet a minimum standard of insulation and heating, is top of the list.

This Bill is awaiting it’s Third Reading and should be passed into law by the end of the year.

The Residential Tenancies Act Amendment Bill, which is proposing changes to tenant liability, unlawful tenancies and methamphetamine, should also be passed into the law at some stage.

Only the Greens voted against National’s Bill in its First Reading and unless Labour and New Zealand First flip, these changes should come into effect.

However, with the Bill currently at the Select Committee stage, don’t be surprised if there are subtle changes before it’s Second Reading.

Extending Notice Periods to 90 days

The biggest changes that Labour have proposed face a lengthier wait.

Labour’s rental policy include scrapping letting fees for tenants, extending notice periods to 90 days abolishing “no-cause” terminations and limiting rent increases to once a year.

All these changes, particularly the adoption of the Australian model for letting fees, where property managers bill the landlord for the cost of finding a new tenant, will create a fair amount of disruption to the industry.

Tenancy consultant Scotney Williams believes these proposed changes reflect the current state of flux in the industry.

“Landlords and property managers will have to accommodate significant changes to their business model,” Williams said.

“With the new Government promising to abolish the requirement for tenants to pay letting fees, property management firms will have to charge their owner clients a fee to replace the abolished letting fee formerly paid by tenants or suffer reduced income.

“Property managers and landlords will also find terminating periodic tenancies much harder with the removal of the “no cause terminations, involving the use of the 90 day Notice”.

Labour’s rental policy isn’t a priority in their first 100 days in office.

But that doesn’t mean it won’t happen and there is a possibility that the Greens’ initiative of a compulsory Rental WOF could be added to the mix.

A lot will depend on New Zealand First.

Sound familiar?

Is your rental property completely compliant?

There has been a case recently where a tenant has been able to claim a refund through Tenancy Tribunal when the tenant found out that the property was not fully compliant.

Without going into too much detail of the case, some work had been done to convert part of the premises into a living space by a previous owner but the work did not have a permit. The new owner was not aware of this and there is no suggestion that this was intentional. The landlord as soon as he was made aware of the situation obtained a Certificate of Acceptance. There are other parts of this story but no need to go into those at this stage. The tenant was refunded the rent paid even though this was just a small part of the property and the property was in excellent order. The Tribunal decided the tenancy was not legal.

This got us thinking about how far this could go. We have to be very careful with the word sleepout and unless we know it is permitted as such we will only allow it to be a hobbies room or similar. So, do not allow a tenant to sleep anywhere that is not correctly permitted. Some tenants think they can sleep in the garage!

We must make sure all situations are covered that require permits or compliance certificates: wood burners, electrical work, plumbing etc. It is not just insurance issues that may come back to bite us, but also possible Tribunal claims. We do ask all owners when they sign up with us if everything in the house is compliant. However you don’t know what you don’t know and if you buy a house without a LIM report it could come back to bite you.

If you are thinking about buying an investment property we strongly recommend a LIM report and a meth test as part of the agreement. In addition to this plumbing and electrical reports would be a wise move. By the way, do not forget to find out what the insulation is and to what standard; that could save you a heap of money going forward.

The cost to self-managing landlords for ‘poor management’

Nothing is worse than when a disgruntled tenant throws the book at you and you have to defend yourself.

Professional property management provides a strong layer of protection for you at a relatively minimal cost.

Imagine for a moment your current tenant gets ‘offside’ with you about a relatively minor disagreement, or if they take exception for you filing a legal notice against them for something rather small (e.g. cleanliness, rent arrears or disturbing neighbours).

Or, you want to claim the bond back, the tenants are upset and again they file against you.

The potential court imposed costs through ‘poor management’:

- Discrimination (up to $4,000)

- Not providing an address for service (up to $500)

- Being overseas for longer than 21 days without appointing an agent (up to $1,000)

- Requiring ‘key money’ (up to $1,000)

- Requiring a bond that is too large (up to $1,000)

- Requiring un-authorised security (up to $1,000)

- Not lodging the bond within the correct time (up to $1,000)

- Requiring more than two weeks rent in advance (up to $1,000)

- Charging a rent too high relative to the market (by order) (up to $200)

- Failure to provide a tenant receipts for rent (up to $200)

- Failing to keep adequate records (up to $200)

- Getting rid of tenants goods incorrectly (up to $2,000)

- Interfering with tenants privacy (up to $2,000)

- Non-compliance around means of escape from fire (eg alarms, locks etc) (up to $3,000)

- Not meeting obligations around cleanliness (up to $4,000)

- Not meeting obligations around maintenance (up to $4,000)

- Not meeting obligations around smoke alarms (up to $4,000)

- Not meeting obligations around insulation (up to $4,000)

- Not meeting obligations around building matters (up to $4,000)

- Not meeting obligations around health and safety (up to $4,000)

If you have not complied, or are not currently complying with the list above you are running a risk. Getting good advice from a professional property manager can really help. Give your property manager a call now to discuss about this.